shooting star forex: Shooting Star and Hammer Candlestick Patterns Open Close Price

Contents:

It is reversal pattern that has long Lower Shadow and tiny or no Upper Shadow. Our maximum loss will be equal to the distance between the level we short HPQ and the level of the stop loss order. This way, if the price creates an unexpected bullish move caused by high volatility, we will be protected. As you see, the candle has a small body located in the lower part of the pattern. It will draw real-time zones that show you where the price is likely to test in the future.

Technical Market Outlook and Review: US CPI data eyed – Leaprate Forex Trading News

Technical Market Outlook and Review: US CPI data eyed.

Posted: Tue, 14 Feb 2023 08:00:00 GMT [source]

You can see the created bearish channel that is plotted with the two downward pointing trendlines. Let’s now explore another example of the shooting star trading set up. This time we will look at trading the shooting star candlestick when it appears within the corrective phase of a larger down trending market. The stop loss should be placed beyond the high of the breakout candle. So now we have protected the position in case the trade begins to move against us. Fortunately for us, the price action started to move lower precipitously following the breakout signal.

Bullish Engulfing Candlestick Pattern: What Is and How to Trade

First, it has a long upper shadow and a small or no lower shadow. It should be emphasized that when the resistance was broken out, the price successfully tested this level and headed up. A bullish hammer and an inverted hammer are forming there as well.

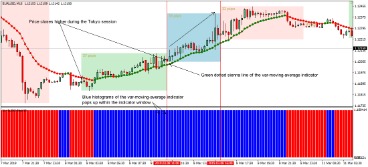

A shooting star pattern with a small real body at the bottom of a price range and a long upper shadow that signals a likely peak on the chart. The classic shooting star does not have a lower shadow or is too short. In approximately the center of the chart, you can see a strong, sustained up move in GBP/USD.

What is Pullback in Forex and What Should We Know About It

After all, nothing is 100% guaranteed in stock trading, and you may experience false signals when trading the shooting star pattern. The shooting star is a single bearish candlestick pattern that is common in technical analysis. The candle falls into the “hammer” group and is a first cousin of the – hanging man, hammer, and inverted hammer. If you’re unfamiliar with any of these patterns, check out our Quick Reference Guide. When a shooting star candlestick forms at the resistance zone, then open a sell order instantly.

The Shooting Star formation is considered less bearish, but nevertheless bearish when the open and low are roughly the same. Our profit-taking order is a simple trend line that shows where the pair bottomed during the previous attempt to move lower. ThinkMarkets ensures high levels of client satisfaction with high client retention and conversion rates.

Shooting star Example

The color of the patterns does not matter; they can be either bearish or bullish. Only the pattern structure is important, namely the small body of the candle in the lower price range and the long upper shadow. A shooting star forex pattern is therefore a bearish reversal candlestick that generally appears after a rise in price and signals a potential change in trend direction. Keep in mind that the shooting star candlestick should never be viewed in isolation. Before acting on the formation, confirm the signal using technical indicators.

The colour of the shooting star candlestick does not matter, either red or green. The only thing that matters is the candlestick’s location, prior trend, and structure. Japanese traders introduce candlestick patterns, and now they are widely used by retail traders to technical analyse the trend of an asset worldwide. When it comes to ascertaining bearish reversals, overbought conditions are of utmost importance. The shooting star pattern appearing as soon as the RSI moves above the 70 levels and into overbought territories should be a warning sign of potential price reversals. The emergence of a strong bearish candlestick that opens and closes below the shooting star candle affirms bears are in control of the market.

Therefore, it should always be used with other indicators or confirmation candles. The shooting star pattern would provide a more accurate trading signal when it occurs near a resistance level when trading forex. Its appearance, in this case, will imply bulls are exiting the market as they do not expect the price to move above the level. The resistance level also allows one to try and sell the market at highs. First, you need to ensure that the asset’s price is in a bullish trend.

At this point, the longs who were late to the party begin to get scared and start to sell out as well. This panic long selling and short selling leads to a sharp reversal in the price action, thus generating a small candlestick body on the chart. This is the simple psychology behind the shooting star candle that every retail trader must learn in technical analysis. Here, the position of the bullish hammer candlestick formation is perfectly positioned, although the candlestick’s body is quite small.

AUD/USD Forex Signal: Shooting Star Pattern Points to a Drop to … – DailyForex.com

AUD/USD Forex Signal: Shooting Star Pattern Points to a Drop to ….

Posted: Thu, 26 Jan 2023 08:00:00 GMT [source]

We have discussed a number of candlestick patterns on the Tradingsim blog. If you haven’t checked out our other resources be sure to do so, you’ll find a really nice candlestick pattern cheat sheet… If you find yourself overwhelmed or new to candlestick patterns, the best way to get a firm grasp of the strategies is through deliberate practice. The reason we point this out is that often a hammer candle will precede a trend reversal in the same way that a shooting star will.

The downward activity then resumes and 18 periods after we https://g-markets.net/ HPQ, the price action closes a candle below the minimum target of the pattern. In such cases, the shooting star candle is likely to have an even bigger upper candlewick. This implies that the price is about to reverse with even bigger strength.

Several candlesticks show the currency pair moving sharply higher, but then a candlestick forms a shooting star pattern. There is a long upper tail or upper shadow, a comparatively much shorter lower tail or shadow, and a noticeably short body with the price closing below the candle’s opening price. The shooting star pattern is just one of many signals of potential market reversals recognized in candlestick charting. Other reversal patterns include engulfing candles, the hanging man pattern, and doji candlestick formations. Looking closely at the number of candles following the shooting star pattern, we can see that the third candle broke below and closed below the upsloping trendline. As such, that event served as the confirmation for a short entry based on this trade set up.

- Get a healthy mix of technical analysis and the movers and shakers.

- After all, you are anticipating an upcoming bearish price move.

- This can be seen by the overlapping price action leading up to the shooting star candle.

- I accept FBS Agreement conditions and Privacy policy and accept all risks inherent with trading operations on the world financial markets.

- Remember that the shooting star could indicate negative reversal – in other words, market prices could go down.

Let’s now take a closer look at two typical scenarios wherein the shooting star formation is often seen. The first scenario is when the market is exhibiting a clear uptrend, and the second scenario is when the market is correcting to the upside within a larger downtrend. In our discussion here, we will focus on a specific single candle pattern referred to as the shooting star.

Inshooting star forex such as investors’ sentiment and emotions can often be determined by the candlesticks’ shape, magnitude, and colors. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk.

- Both show the same candlestick formation; however, the position is different.

- Based on the observation that prices were earlier rejected at the shooting star’s high, it will be practical to place a stop loss order at the last swing high .

- It is a reversal pattern that is most often seen after a price rise.

- They are very useful in finding reversals and continuation patterns on charts.

- Traders can place short positions at this level with a stop loss order a few pips above the shooting star highs.

With neither buyers or sellers able to gain the upper hand, a spinning top shows indecision. For a candlestick to be considered a shooting star, the formation must appear during a price advance. Also, the distance between the highest price of the day and the opening price must be more than twice as large as the shooting star’s body. In terms of the characteristics of the pattern – The shooting star reversal pattern has a long upper shadow, short lower shadow, and a small real body.

And with that, we have confirmation of shooting star pullback set up. In order to do this, we will need to draw an uptrend line that connects the lower swing points within the rising trend. The shooting star pattern must occur above this uptrend line, and the price must break below this trendline within five bars of the shooting star formation.

For a profit price target, it is best to use Fibonacci retracement levels and set your take profit order at one of the Fibonacci levels. If the open, low, and closing prices are almost the same, you can see a shooting star formation that, often interpreted by traders as a sign for a bearish move. A shooting star candlestick pattern occurs when an asset’s market price is pushed up quite significantly, but then rejected and closed near the open price. It could be a possible signal of bearish reversal, meaning an uptrend might not continue.